Ercros closes the first half of the year with a EUR 5.6 million profit

Barcelona

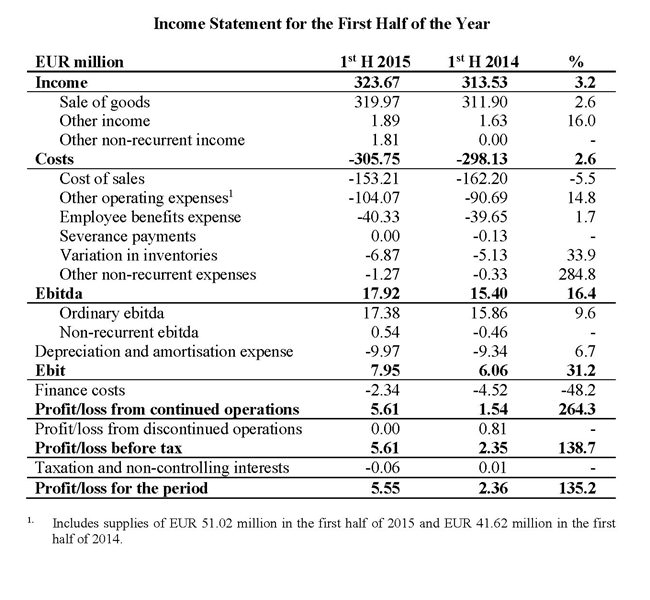

The first half of 2015 has confirmed the recovery of Ercros's business indicated at the onset of the year. The company has reported a profit of EUR 5.55 million, against a profit of EUR 2.36 million in the first half of 2014, an improvement of EUR 3.19 million on the same period last year.

Turnover in the first six months of 2015 was EUR 319.97 million, which is a growth of 2.6% on the first half of 2014 (EUR 311.90 million). This growth is owing to the recovery of activities and the growing strength of the dollar against the euro, which has enabled both an improvement in end product prices, particularly in the dollar market, and an increase in sales volumes due to increased exports.

Foreign sales represented 49% of all sales, which is a 1% rise on the same period of 2014. By markets, sales grew 23% in OECD countries and the rest of the world (dollar area), while EU sales dropped 6.6% and domestic sales grew marginally (0.7%).

This situation has benefited the pharmacy and intermediate chemicals divisions, whose turnover largely originates from foreign markets.

Specifically, the pharmacy division has seen a 28% improvement in its sales thanks to the positive performance of its leading products, and has closed the first half of the year with a profit of EUR 2.89 million, compared to EUR 0.38 million in the first half of 2014.

The intermediate chemicals division has also seen a rise in sales, of 1.7%. This rise, together with the lower cost of its most important raw material, methanol, has enabled a significant improvement in business margins, translating to a six-month profit report of EUR 5.37 million –2.5 times greater than results of the first half of last year, at 2.16 EUR million.

With respect to the chlorine-related business group, in spite of the minor increase in sales (0.4%), resulting from the improved price of caustic soda and the rising sales of PVC, the sharp rise in energy prices has been detrimental to the profitability of these businesses, leading to a loss for the first half of the year of EUR 2.71 million, compared to a loss of EUR 0.18 million for the same period of 2014.

Returning to profit and loss for the company as a whole, costs rose in 2015 by 2.6%, to EUR 305.75 million (EUR 298.13 million in the first half of 2014). Specifically, personnel costs rose 1.7%, principally due to the partial recovery from salary freezes agreed in prior years. Between January and June 2015, the average Ercros workforce was formed of 1,368 people, which is a drop of 20 people on the previous year, mainly due to the sale of the Palos de la Frontera factory, which will be further commented on below.

The most significant fluctuation in cost occurred among variable costs. Provisions dropped 5.5% due to the drop in raw materials, led by ethylene and methanol. Moreover, other operating costs rose 15%, mainly due to increased supplies. Within this heading, electricity cost is a major element, having risen 26% and with an impact of EUR 8.96 million on the company's ebitda, which is equal to the drop in the cost of provisions.

The positive performance of dollar markets, the lesser cost of raw materials and improved productivity have all helped to neutralise the sharp rise in electricity prices and to contribute to an increase in ebitda from EUR 15.40 million in 2014, to EUR 17.92 million in 2015. This is an improvement of EUR 2.52 million, equivalent to growth of 16.4%. Concerning sales, the ebitda margin rose from 4.9% to 5.6%.

Following amortisations, which rose 6.7%, and the financial result, which is significantly improved thanks to exchange rate differences recorded by the rising strength of the dollar against the euro, results for the first half of 2015 were EUR 5.55 million; a figure which is more than double the results obtained for the period of January to June 2014, at EUR 2.36 million.

On June 2nd 2015, Ercros and Salinas del Odiel formalised the sale and purchase of Electroquímica Onubense, a subsidiary of Ercros, owner of the Palos de la Frontera factory and holder of the concession for the Huelva Salt Flats, following Ercros's contribution on May 1st of this year. The total price of this transaction was EUR 3.95 million, and it has had no impact on the income statement.

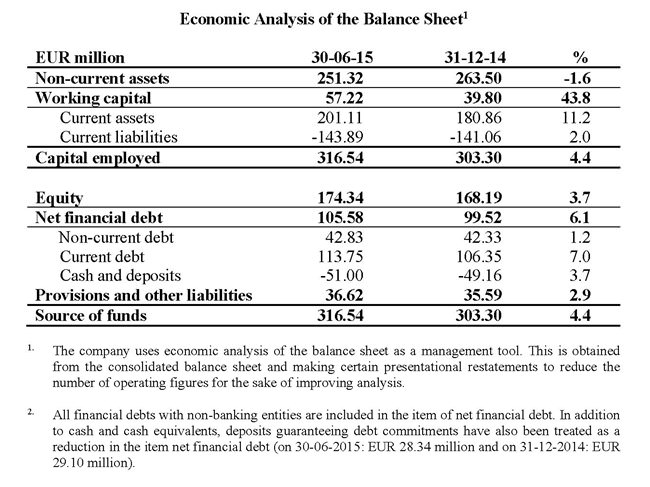

Economic analysis of the balance sheet reveals a drop of EUR 4.18 million on non-current assets due to increased amortisations and the containment of investments. Working capital rose EUR 17.42 million due to rising sales.

Results obtained and the amount of the most recent capital contribution paid out in January 2015 have contributed to improving company equity, which rose by EUR 6.15 million between December 31st 2014 and 30th June 2015.

At the close of the first half of the year, financial debt amounted to EUR 105.58 million. The increase in debt of EUR 6.06 million is owing to the greater use of the syndicated factoring contract, which has been possible thanks to recovery in sales and the more favourable conditions of this new contract.

Looking ahead to the rest of 2015, Ercros is confident it will maintain buoyant activities (even taking into account the typical slower pace of the second half of the year), and will obtain margins without significant changes, with the exception of the chlorine-related business group which may face further electricity price rises, pursuant to market forecasts. Despite this, the company expects to reach year end still on its present track of recovery. In the medium term, the challenge for the company is the restructuring of the chlorine-related business group as a result of the ban on the use of mercury cell technology in electrolysis plants from December 11th 2017.

Turnover in the first six months of 2015 was EUR 319.97 million, which is a growth of 2.6% on the first half of 2014 (EUR 311.90 million). This growth is owing to the recovery of activities and the growing strength of the dollar against the euro, which has enabled both an improvement in end product prices, particularly in the dollar market, and an increase in sales volumes due to increased exports.

Foreign sales represented 49% of all sales, which is a 1% rise on the same period of 2014. By markets, sales grew 23% in OECD countries and the rest of the world (dollar area), while EU sales dropped 6.6% and domestic sales grew marginally (0.7%).

This situation has benefited the pharmacy and intermediate chemicals divisions, whose turnover largely originates from foreign markets.

Specifically, the pharmacy division has seen a 28% improvement in its sales thanks to the positive performance of its leading products, and has closed the first half of the year with a profit of EUR 2.89 million, compared to EUR 0.38 million in the first half of 2014.

The intermediate chemicals division has also seen a rise in sales, of 1.7%. This rise, together with the lower cost of its most important raw material, methanol, has enabled a significant improvement in business margins, translating to a six-month profit report of EUR 5.37 million –2.5 times greater than results of the first half of last year, at 2.16 EUR million.

With respect to the chlorine-related business group, in spite of the minor increase in sales (0.4%), resulting from the improved price of caustic soda and the rising sales of PVC, the sharp rise in energy prices has been detrimental to the profitability of these businesses, leading to a loss for the first half of the year of EUR 2.71 million, compared to a loss of EUR 0.18 million for the same period of 2014.

Returning to profit and loss for the company as a whole, costs rose in 2015 by 2.6%, to EUR 305.75 million (EUR 298.13 million in the first half of 2014). Specifically, personnel costs rose 1.7%, principally due to the partial recovery from salary freezes agreed in prior years. Between January and June 2015, the average Ercros workforce was formed of 1,368 people, which is a drop of 20 people on the previous year, mainly due to the sale of the Palos de la Frontera factory, which will be further commented on below.

The most significant fluctuation in cost occurred among variable costs. Provisions dropped 5.5% due to the drop in raw materials, led by ethylene and methanol. Moreover, other operating costs rose 15%, mainly due to increased supplies. Within this heading, electricity cost is a major element, having risen 26% and with an impact of EUR 8.96 million on the company's ebitda, which is equal to the drop in the cost of provisions.

The positive performance of dollar markets, the lesser cost of raw materials and improved productivity have all helped to neutralise the sharp rise in electricity prices and to contribute to an increase in ebitda from EUR 15.40 million in 2014, to EUR 17.92 million in 2015. This is an improvement of EUR 2.52 million, equivalent to growth of 16.4%. Concerning sales, the ebitda margin rose from 4.9% to 5.6%.

Following amortisations, which rose 6.7%, and the financial result, which is significantly improved thanks to exchange rate differences recorded by the rising strength of the dollar against the euro, results for the first half of 2015 were EUR 5.55 million; a figure which is more than double the results obtained for the period of January to June 2014, at EUR 2.36 million.

On June 2nd 2015, Ercros and Salinas del Odiel formalised the sale and purchase of Electroquímica Onubense, a subsidiary of Ercros, owner of the Palos de la Frontera factory and holder of the concession for the Huelva Salt Flats, following Ercros's contribution on May 1st of this year. The total price of this transaction was EUR 3.95 million, and it has had no impact on the income statement.

Economic analysis of the balance sheet reveals a drop of EUR 4.18 million on non-current assets due to increased amortisations and the containment of investments. Working capital rose EUR 17.42 million due to rising sales.

Results obtained and the amount of the most recent capital contribution paid out in January 2015 have contributed to improving company equity, which rose by EUR 6.15 million between December 31st 2014 and 30th June 2015.

At the close of the first half of the year, financial debt amounted to EUR 105.58 million. The increase in debt of EUR 6.06 million is owing to the greater use of the syndicated factoring contract, which has been possible thanks to recovery in sales and the more favourable conditions of this new contract.

Looking ahead to the rest of 2015, Ercros is confident it will maintain buoyant activities (even taking into account the typical slower pace of the second half of the year), and will obtain margins without significant changes, with the exception of the chlorine-related business group which may face further electricity price rises, pursuant to market forecasts. Despite this, the company expects to reach year end still on its present track of recovery. In the medium term, the challenge for the company is the restructuring of the chlorine-related business group as a result of the ban on the use of mercury cell technology in electrolysis plants from December 11th 2017.

Ercros guarantees that the relevant facts contained on this page correspond exactly to those sent by the Company to the CNMV, and disseminated by it to the market. The facts prior to those included in this section are available on the CNMV website.