Ercros reports first half 2016 earnings up to EUR 19.6 million

Barcelona

Ercros has ended the first half of 2016 with a profit of EUR 19.64 million, 3.5 times higher than that recorded in the same period of last year.

This profit beats previous estimates made by the company on 25 Mays exceeding in EUR 2.64 million the company' estimates, as a result of the efforts made to strengthen the sales of better performing products and the cost cut arising from the restructuring programmes implemented in recent years that have better shaped the company, reducing overheads and enabling the company to benefit from the economic recovery.

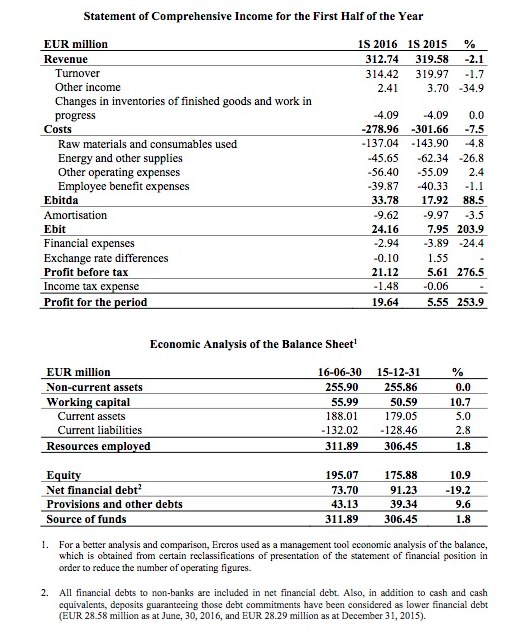

In the first six months of 2016, turnover reached EUR 314.42 million, 1.7 % below first half of 2015 turnover. This drop is explained by: (a) inclusion in the previous period of sales by the Palos plant and Salina de Huelva, which were sold on 2 June 2015; and (b) the impact of the passing on to customers the lower raw materials prices (methanol and ethylene), with higher impact on the sales of the Intermediate Chemicals Division. In other divisions –the Chlorine Related Division and the Pharmaceuticals Division– turnover has risen (3 % and 6 %, respectively).

Costs amounted to EUR 278.96 million, a drop of 7.5 % compared with the same period of the previous year. The items under this heading showing the greatest variation compared with the first half of 2015 were procurements –down 26.8% due to lower electricity and gas prices– and supplies –down 4.8% due to the lower cost of raw materials. In the last six months the ratio Raw material plus Energy and other supplies to turnover has declined from 64% to 58%, a drop of six percentage points.

Mention should also be made of the 1.1 % reduction in personnel costs due to the combined effect of, on the one hand, a reduction in the average number of employees of 33 persons, mainly as a result of the abovementioned sale of the Palos de la Frontera facilities, and, on the other, a 3.5% wage increase. The wage increase included the recovery of the amount pending from the wage freeze in the 2010-2012 period. As at 30 June 2016 the company had 1,368 employees.

Between the first half of 2015 and the first half of 2016 ebitda has increased from EUR 17.92 million to EUR 33.78 million, a rise of EUR 15.86 million, that represents an improvement of 88.5 %. The largest increase corresponds to the Chlorine Related Division, whose ebitda was up 3.8 times, reaching 20.67 million euros; ebitda in the Pharmaceuticals Division improved by 10%, and that of the Intermediate Chemicals Division was up by 3%. As a result of this improvement there has been a significant improvement in the company’s gross margin (ebitda to sales), which has risen from 5.6% to 10.7%.

There has been little change in amortisation charges, while financial expenses were down 24.4%. Exchange rate differences were EUR -0.10 million, compared to EUR 1.55 million in the first six months of 2015, because of the relative recovery of the euro against the US dollar. Lastly, income tax s amounted to EUR 1.48 million, compared with EUR 0.06 million in the first half of 2015.

As a result of the above, in the first six months of 2016 Ercros has posted a profit of EUR 19.64 million, compared with EUR 5.55 million recorded in the same period of 2015, an increase of EUR 14.09 million.

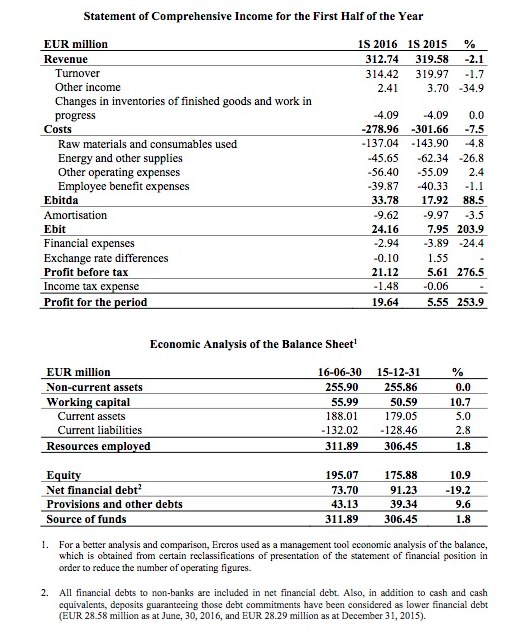

In the balance sheet, the following items should be highlighted: working capital has increased by EUR 5.40 million due to higher accounts receivables, and equity has risen by EUR 19.19 million s from the profits obtained during the period. At the end of the half-year, net financial debt stood at EUR 73.70 million, compared with EUR 91.23 million as at December 31, 2015, a reduction of EUR 17.53 million reflected in the debt coverage ratio (net financial debt/ebitda) that in the last 12 months has improved from 6.23 to 1.52.

Looking forward to the remainder of 2016, Ercros expects to continue the positive trend seen in the first half of the year, notwithstanding that the second half should be negatively affected by the lowers sales for the months of August and December, due to seasonal reasons.

Download document

Download document

This profit beats previous estimates made by the company on 25 Mays exceeding in EUR 2.64 million the company' estimates, as a result of the efforts made to strengthen the sales of better performing products and the cost cut arising from the restructuring programmes implemented in recent years that have better shaped the company, reducing overheads and enabling the company to benefit from the economic recovery.

In the first six months of 2016, turnover reached EUR 314.42 million, 1.7 % below first half of 2015 turnover. This drop is explained by: (a) inclusion in the previous period of sales by the Palos plant and Salina de Huelva, which were sold on 2 June 2015; and (b) the impact of the passing on to customers the lower raw materials prices (methanol and ethylene), with higher impact on the sales of the Intermediate Chemicals Division. In other divisions –the Chlorine Related Division and the Pharmaceuticals Division– turnover has risen (3 % and 6 %, respectively).

Costs amounted to EUR 278.96 million, a drop of 7.5 % compared with the same period of the previous year. The items under this heading showing the greatest variation compared with the first half of 2015 were procurements –down 26.8% due to lower electricity and gas prices– and supplies –down 4.8% due to the lower cost of raw materials. In the last six months the ratio Raw material plus Energy and other supplies to turnover has declined from 64% to 58%, a drop of six percentage points.

Mention should also be made of the 1.1 % reduction in personnel costs due to the combined effect of, on the one hand, a reduction in the average number of employees of 33 persons, mainly as a result of the abovementioned sale of the Palos de la Frontera facilities, and, on the other, a 3.5% wage increase. The wage increase included the recovery of the amount pending from the wage freeze in the 2010-2012 period. As at 30 June 2016 the company had 1,368 employees.

Between the first half of 2015 and the first half of 2016 ebitda has increased from EUR 17.92 million to EUR 33.78 million, a rise of EUR 15.86 million, that represents an improvement of 88.5 %. The largest increase corresponds to the Chlorine Related Division, whose ebitda was up 3.8 times, reaching 20.67 million euros; ebitda in the Pharmaceuticals Division improved by 10%, and that of the Intermediate Chemicals Division was up by 3%. As a result of this improvement there has been a significant improvement in the company’s gross margin (ebitda to sales), which has risen from 5.6% to 10.7%.

There has been little change in amortisation charges, while financial expenses were down 24.4%. Exchange rate differences were EUR -0.10 million, compared to EUR 1.55 million in the first six months of 2015, because of the relative recovery of the euro against the US dollar. Lastly, income tax s amounted to EUR 1.48 million, compared with EUR 0.06 million in the first half of 2015.

As a result of the above, in the first six months of 2016 Ercros has posted a profit of EUR 19.64 million, compared with EUR 5.55 million recorded in the same period of 2015, an increase of EUR 14.09 million.

In the balance sheet, the following items should be highlighted: working capital has increased by EUR 5.40 million due to higher accounts receivables, and equity has risen by EUR 19.19 million s from the profits obtained during the period. At the end of the half-year, net financial debt stood at EUR 73.70 million, compared with EUR 91.23 million as at December 31, 2015, a reduction of EUR 17.53 million reflected in the debt coverage ratio (net financial debt/ebitda) that in the last 12 months has improved from 6.23 to 1.52.

Looking forward to the remainder of 2016, Ercros expects to continue the positive trend seen in the first half of the year, notwithstanding that the second half should be negatively affected by the lowers sales for the months of August and December, due to seasonal reasons.

Ercros guarantees that the relevant facts contained on this page correspond exactly to those sent by the Company to the CNMV, and disseminated by it to the market. The facts prior to those included in this section are available on the CNMV website.